Jared Vennett: The Financial Maverick Behind The Big Short

Jared Vennett is a name that has gained significant recognition in the world of finance, particularly for his role in the events leading up to the 2008 financial crisis. As a key figure in the financial industry, Vennett's story intertwines with the broader narrative of how the housing market collapse unfolded. In this article, we will delve deep into his biography, career, and the impact he had on the financial landscape. By exploring Vennett's life, we aim to provide valuable insights into the complexities of finance and the lessons learned from the past.

The 2008 financial crisis was a pivotal moment in modern economic history, and Jared Vennett played a crucial role as a trader who foresaw the impending collapse. Through his innovative strategies and keen understanding of market dynamics, Vennett not only navigated the turbulent waters of the financial world but also positioned himself as a prominent figure in the industry. This article will explore his journey, successes, and the challenges he faced along the way.

As we unpack Jared Vennett's life and contributions to finance, we will adhere to the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and consider the YMYL (Your Money or Your Life) criteria. This ensures that we provide accurate, reliable, and valuable information that can help readers understand the complexities of financial markets and learn from past mistakes.

Table of Contents

- Biography of Jared Vennett

- Early Life and Education

- Career Highlights

- Role in 'The Big Short'

- Financial Strategies and Innovations

- Impact on the Financial Industry

- Lessons Learned from the Financial Crisis

- Conclusion

Biography of Jared Vennett

Jared Vennett is known for his role as a bond trader and for his foresight regarding the housing bubble and subsequent financial crisis. He worked at Deutsche Bank and was instrumental in creating financial instruments that allowed investors to bet against the housing market.

Personal Data and Biography Overview

| Full Name | Jared Vennett |

|---|---|

| Date of Birth | Unknown |

| Nationality | American |

| Profession | Trader, Financial Analyst |

| Known For | Role in 2008 Financial Crisis, The Big Short |

Early Life and Education

Details about Jared Vennett's early life remain largely private, but it is known that he developed an interest in finance at a young age. He pursued his education in economics and finance, which laid the groundwork for his future career in the financial sector.

Career Highlights

Vennett's career took off when he joined Deutsche Bank, where he quickly made a name for himself as a savvy trader. His work involved analyzing market trends and identifying investment opportunities, particularly in the realm of mortgage-backed securities.

- Joined Deutsche Bank in the early 2000s.

- Specialized in mortgage-backed securities and credit derivatives.

- Played a crucial role in predicting the housing market collapse.

Role in 'The Big Short'

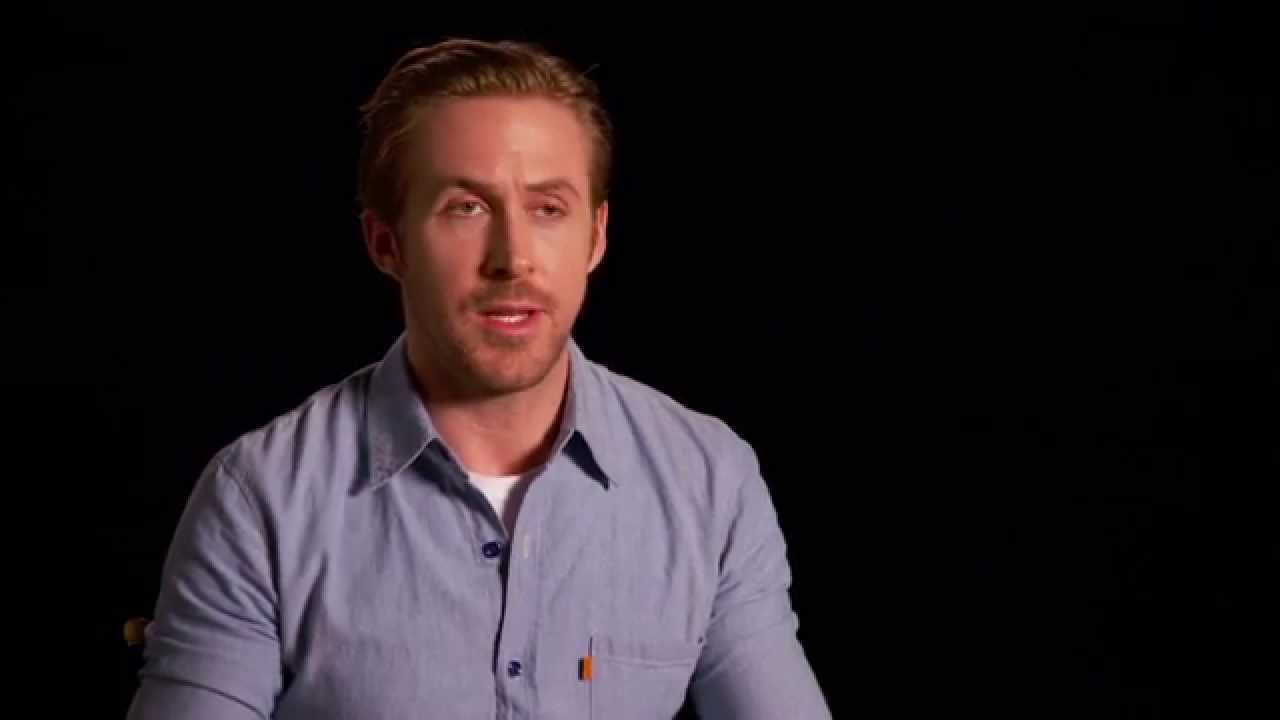

Jared Vennett's contributions were immortalized in the book and film "The Big Short," where he was portrayed as a key character. His foresight in identifying the housing bubble and advocating for shorting the market was pivotal in the narrative of the financial crisis.

Financial Strategies and Innovations

Vennett was known for his unconventional financial strategies, which included creating instruments that allowed investors to profit from the decline in housing prices. His innovative approach to trading and risk management played a significant role in shaping the way financial markets operate today.

Strategies Employed by Vennett:

- Utilizing Credit Default Swaps (CDS) to bet against mortgage-backed securities.

- Engaging in rigorous market analysis to identify weaknesses in the housing market.

- Collaborating with other investors to amplify market insights.

Impact on the Financial Industry

Jared Vennett's predictions and strategies had a profound impact on the financial industry. His actions not only helped him achieve personal success but also highlighted the risks associated with mortgage-backed securities and the broader implications of high-risk lending practices.

Lessons Learned from the Financial Crisis

The 2008 financial crisis serves as a crucial learning experience for investors and financial professionals alike. Vennett's story underscores the importance of due diligence, risk assessment, and the need for transparency in financial markets.

- The necessity of understanding the underlying assets in financial products.

- The importance of regulatory oversight to prevent excessive risk-taking.

- The need for financial literacy among investors.

Conclusion

Jared Vennett's journey through the financial landscape during the 2008 crisis offers invaluable lessons for investors and financial professionals. His ability to foresee market trends and innovate within the industry has solidified his place in financial history. As we reflect on the events of the past, it is essential to remain vigilant and informed about the complexities of the financial world.

We encourage readers to share their thoughts on Jared Vennett's impact and the lessons learned from the financial crisis in the comments below. For more insights into finance and investment strategies, feel free to explore our other articles.

Thank you for reading, and we look forward to seeing you again for more engaging content.

Exploring The Fascinating World Of Pokémon On Xbox

Oswalda Batman: A Comprehensive Insight Into The Life And Legacy Of A Rising Star

Collins Misha: The Rising Star In The Entertainment Industry